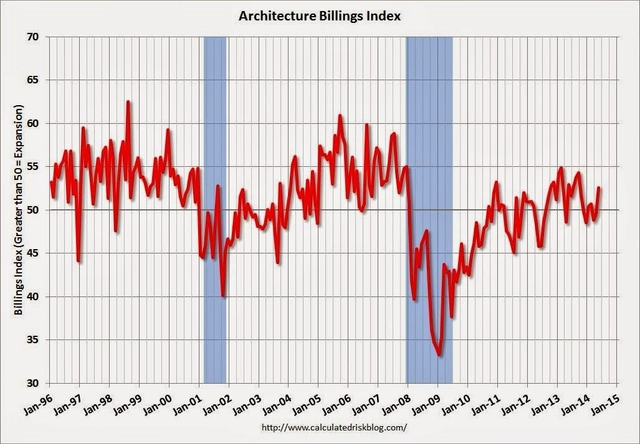

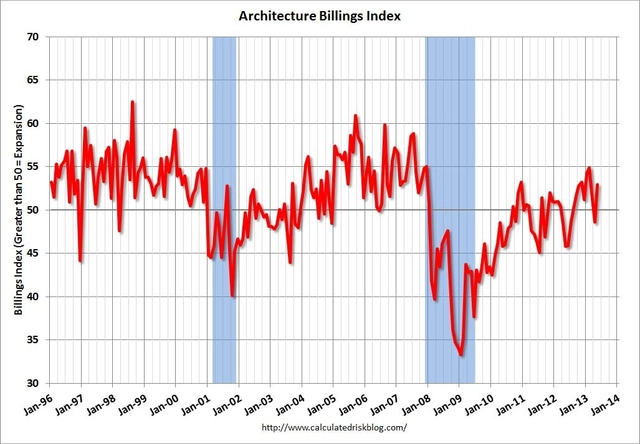

While the US Architecture Billing Index (ABI) has remained positive for seven consecutive months, the score continues to slowly drop and is now teetering on the edge of falling into the red. As the American Institute of Architects (AIA) says, any score above 50 reflects an increase in design services. However, November's ABI score was 50.9, down from the mark of 53.7 in October, revealing a drop in demand. The new projects inquiry index was 58.8, following a mark of 62.7 the previous month.

“Demand for design services has slowed somewhat from the torrid pace of the summer, but all project sectors are seeing at least modest growth,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Architecture firms are expecting solid mid-single digit gains in revenue for 2014, but heading into 2015, they are concerned with finding quality contractors for projects, coping with volatile construction materials costs and with finding qualified architecture staff for their firms.”

A breakdown of regional highlights, after the break.