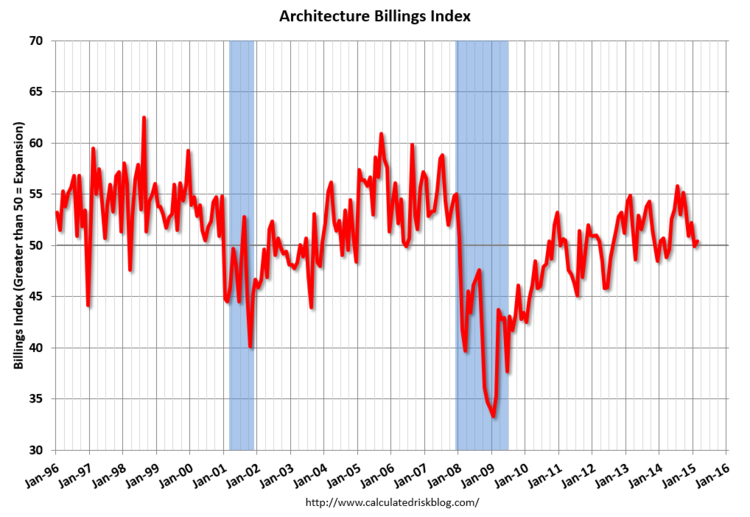

The American Institute of Architects (AIA) has reported that the Architecture Billings Index (ABI) has remained positive in July for the sixth consecutive month, and tenth out of the last twelve months as demand across all project types has continued to increase. The July ABI score was 51.5, down from 52.6 in June, but nonetheless still reflects an increase in design services, as any score above 50 indicates an increase in billings. The new projects inquiry index was 57.5, down from a mark of 58.6 the previous month.